Moving Average(MA) is one of the most popular indicators. There are several types of moving average such as Simple Moving Average (SMA or MA only), Exponential Moving Average (EMA), and weighted Moving Average (WM A). MA is basically an average closing market price for one time frame that has been set. MA is just like a ruler which will move up or down according to the market direction.

It is an average closing price movement in a period of time. With MA, we can see the trend of the price. If it's moving to the top it simply means that the trends are growing up and vice versa. When prices penetrate MA mean trend is changing.

Below is an example of 100MA and 50MA. All calculation will be made by a computer program. One of the main functions of MA is to recognize the trend. MA is a kind of indicator of "lagging”. It moves according to the price and not a proactive motion prediction which means it does not predict anything but only clarify the trend whether uptrend or downtrend.

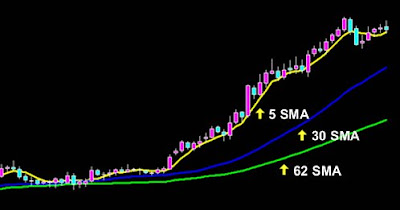

"Momentum" or the strength of trend can be changed by using smaller MA. The smaller average values of MA the stronger its momentum. MA that is less than 20 days may be classified into short-term, 20-100 to be medium-term and above 100 to be long term trend.

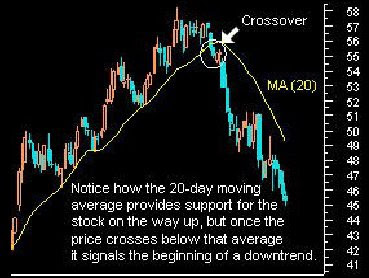

Traders often use more than 1 MA to see the movement of market as a whole, in terms of short, mid and long term MA may also be used for the "level" that can be considered as a support and resistance.

Note the example below. MA (200 days) acts as a powerful support line. Price will rise again when approaching this line. This opportunity should be taken by entry the LONG / BUY position.

In other ways, MA also can act as a barrier (resistance) if the price falls below MA line. Another function of MA is to set our SL value. The characteristic of MA that can be support or resistance can be the "tool" that we can use to minimize our risk during our trade. Note the example below:

In this example, we assume MA200 as support and has a long open position. By knowing that, we can set our SL under this support line.

One of the disadvantages of MA is that it cannot be used when the market is in correction phase or the "Consolidation”. Examples below indicate the disadvantages of MA when the market is not in trend; uptrend or downtrend.

Be careful with the "lag" of MA. Because all of the MA indicators are lagging, the signal provided by the MA is often slow even though the market has made its movement. This phenomenon often occurs when using MA.

Crossover is one of the principle when using MA;when the market moves from the top to the down of MA, or vise versa.

Another method of “crossover" is using more than 1 MA. This type of "Crossover" is valid when "shortterm" MA across above "longterm" MA.

This method is use to identify the "momentum" or the strength of the market movement. Long signal generated when the shortterm MA cross above long term MA while short signal generated when shortterm MA cross below longterm MA.

Example below shows the signal to entry position LONG result of crossover

"Triple crossover" is a way of using 3 types of MA all together. For example MA5, MA10 and MA20 cross between one another. By adding more MA, the false signals may be reduced.

Example of buy signal:

When MA5 cross with the MA10 and ascended to the top, this shows the buy signal was created. However, traders may wait until MA10 and MA20 cross once again and rise to the top. The crossing between MA10 with MA20 can be used to confirm the buy signal generated by initial signal of the MA5 and MA10.

Friday, May 22, 2009

Forex indicator: Moving Average (MA)

Labels: Forex indicator, MA, Moving Average

Posted by just me at 10:26 AM

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment