Theory 123 (Law of charts)

Generally, the price movement will form a zigzag pattern or common theory called 123. Where the distance 1-2 is longer than 2-3 and the price trend will continue in 1-2. This pattern can occur on the chart for several time frame scale only. Strategic Theory 123

Strategic Theory 123

If the pattern 123 occurs where C is the current price then place the entry point at the point B, and Stop Loss at point C, or A. Place the target point approximately half of the AB. When TP1 is reached, move SL to C and so fourth.

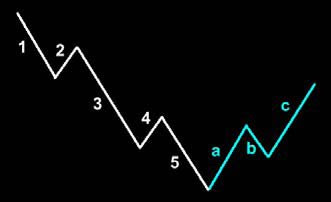

Eliot Wave Theory (Patterns 5-3)

Mr. Elliot found that the price movement has a 5-3 wave pattern, which is always repeated, where the wave pattern 5 is called impulse wave while wave patterns 3 called Corrective wave. Elliot theory based on market psychology, as described below:

Elliot Wave Theory explains the following: Wave 1

Wave 1

Stock prices rise up, because some people hold time to buy.

Wave 2

Stock prices falling down, because some people feel the price is high enough and the right time to take profit.

Wave 3

Prices rise again, because people want to take the profit as at wave 1, and they feel the stock can generate more profit. Usually the price moves higher than wave 1.

Wave 4

The prices go down once again because the price is high enough and the time to take profit.

Wave 5

Prices rise again, due to the tree stock without reason, after reasonable price exceeds the trend changed to the ABC pattern. 5-3 pattern can also form from smaller 5-3 pattern

5-3 pattern can also form from smaller 5-3 pattern

If we observe more, actually this theory is the development of the theory 123 in which Elliot found that in a price movement, pattern 123 occurs 2 times before finally turn its directions.

If we observe more, actually this theory is the development of the theory 123 in which Elliot found that in a price movement, pattern 123 occurs 2 times before finally turn its directions.

Fibonacci Ratio

Fibonacci ratio is the development from theory 123 and Elliot Wave which be combined with the calculation of Fibonacci ratio to determine the level of Support & Resistance.

Basically, the principle is the same as theory 123 where the long waves (1-2) called swing is followed by short wave (2-3) called a retracement. With the calculation of Fibonacci we can know the support and resistance level from the movement of retracement.

Before Fibonacci can be determined we must first defined how swing High and swing Low is place on the chart .

#1 Fibonacci Retracement Level

Usually the movement of retracement will reach 23.6%, 38.2%; 50%, 61.8%, level and then return to the level of 0% before continue to the extension level. If the movement not be able to penetrate the price level of 0% then the price level will move to 100% and vice versa.

#2 Fibonacci Extension Level

#2 Fibonacci Extension Level

Namely support & resistance levels that are expected to be achieved after the successful movement through the price level of 0%

Examples of Theory 123, Elliot Wave & Fibonacci in the chart are shown below.

Examples of Theory 123, Elliot Wave & Fibonacci in the chart are shown below.

- 1,2,3 illustrate Theory 123

- A, B, C, D, E & a, b, c describe the Elliot Wave Theory

- The blue line indicate Fibonacci level & the yellow line is the level expansion Fibonacci

Next we will learn on how to implement these theory in our real trading..

0 comments:

Post a Comment