Example:

C = the current price

B = Buy order entry

A = sell order entry

D = Target Prediction points

When C-D swing form move SL to form B

So your position will secure, risk = 0

When swing E-F form, move SL to E

At this position your profit is safe.

When G-H swing form move SL to G and so on

Strategy 3: Compounding Profit

Add entry point when the price has reached the target.

Example:

Example:C = the current price

B = Buy order entry

A = Sell order entry

D = Target Prediction Points

When the C-D swing move SL to form B

So your position will secure, risk = 0

When swing E-F form move SL to E

At this position your profit is safe.

When prices is at G Buy stop order at F with SL at G

When G-H swing form move SL1 to G and so on.

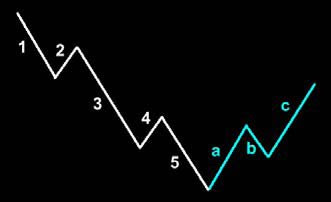

Weaknesses in THEORY 123, Elliot & WAVE FibonacciNot a single theory is 100% perfect as all the theory discussed above. Although the above theory can predict the formation that will occur but it can not really determine the next direction of zigzag? Zigzag direction can occur both above and below.

If we see on the chart the price direction should be increased according to Elliot Wave principle but in reality even zigzag is form below it.

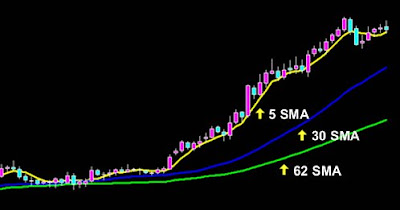

Other weakness that we can observe is that when the sideway movement occur. Sideway movement usually occurs after the existence of a very long swing. To figure out this matter we need to use additional indicators to see its momentum’s strength.

Example: (MACD indicator, Oscilator MA & Slow Stochastic)

After Swing AB occurred for a long time, it then followed by BC retracement and swing CD. At CD, it does not move far away from level B because of the weak momentum (MACD trend Up, Osma Up, Stochastic oversold). Then swing D-E form followed by swing EF where F is touching level D.

According to the theory the price should continue to move down trend, but instead of turning back. This is because of the prices that are not in strong momentum (MACD trend Up, Osma Up, Stochastic oversold). According to the theory, before Swing FG form, once again the price will touch level E and the price should continue rising without turning back (MACD trend is still up, Osma start to decline, stochastic overbought).

When sideway is observe, traders should use additional indicators to make the decisions.

One of the fail Fibonacci example:

A = stop order BUY

B = stop order SELL

C = the current price

SL di 50%

In the above example the price touches the stop order Sell at D but instead of going down to F, the price rise up to E.

Move the stop order Buy to C with SL buy at 50% level of the new swing Fibo.

Price then observes to move back to F, move the stop order Buy to point E with the SL buy at 50% level of the new swing.

When the price level at E, sell orders that have been exposed to active will close after touching SL,

At this time only Buy order is active until it reaches point G. In this example you are at win-win position, mean your risk is at 0.

To overcome the weaknesses of these theories it must be supported by other indicators, support & resistance. And do not forget to add spread in your order entry.

-good luck-

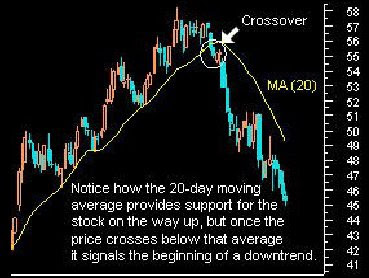

Another important indicator is Stochastic. Stochastic indicator used to read the chart and give us an early signal when one trend may end up. Unlike MACD indicator, Stochastic can determine Overbought or Oversold market conditions as shown below.

Another important indicator is Stochastic. Stochastic indicator used to read the chart and give us an early signal when one trend may end up. Unlike MACD indicator, Stochastic can determine Overbought or Oversold market conditions as shown below. The Stochastic scale range from 0 to 100, when the lines reach 70, it indicates the Overbought condition and the prices will go down after just leaving the scale of 70. Meanwhile, if the line reach 30 it indicates the Oversold condition and the prices will rise once again after leaving the scale of 30. You may notice that Entry & Exit Stochastic signal is preferable the time where stoch leave overbought or oversold area as shown on the chart.

The Stochastic scale range from 0 to 100, when the lines reach 70, it indicates the Overbought condition and the prices will go down after just leaving the scale of 70. Meanwhile, if the line reach 30 it indicates the Oversold condition and the prices will rise once again after leaving the scale of 30. You may notice that Entry & Exit Stochastic signal is preferable the time where stoch leave overbought or oversold area as shown on the chart.

Stochastic has two lines which is % K & % D and normally called trigger line, if both lines intersect with each other it can give us entry or exit signal. Unfortunately trigger signal becomes less accurate as they often give false signal.

Stochastic has two lines which is % K & % D and normally called trigger line, if both lines intersect with each other it can give us entry or exit signal. Unfortunately trigger signal becomes less accurate as they often give false signal.