Moving Average(MA) is one of the most popular indicators. There are several types of moving average such as Simple Moving Average (SMA or MA only), Exponential Moving Average (EMA), and weighted Moving Average (WM A). MA is basically an average closing market price for one time frame that has been set. MA is just like a ruler which will move up or down according to the market direction.

It is an average closing price movement in a period of time. With MA, we can see the trend of the price. If it's moving to the top it simply means that the trends are growing up and vice versa. When prices penetrate MA mean trend is changing.

Below is an example of 100MA and 50MA. All calculation will be made by a computer program. One of the main functions of MA is to recognize the trend. MA is a kind of indicator of "lagging”. It moves according to the price and not a proactive motion prediction which means it does not predict anything but only clarify the trend whether uptrend or downtrend.

"Momentum" or the strength of trend can be changed by using smaller MA. The smaller average values of MA the stronger its momentum. MA that is less than 20 days may be classified into short-term, 20-100 to be medium-term and above 100 to be long term trend.

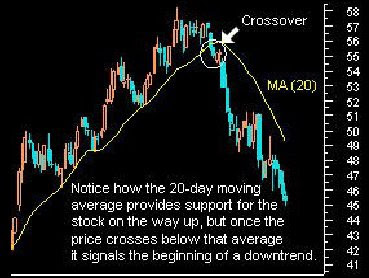

Traders often use more than 1 MA to see the movement of market as a whole, in terms of short, mid and long term MA may also be used for the "level" that can be considered as a support and resistance.

Note the example below. MA (200 days) acts as a powerful support line. Price will rise again when approaching this line. This opportunity should be taken by entry the LONG / BUY position.

In other ways, MA also can act as a barrier (resistance) if the price falls below MA line. Another function of MA is to set our SL value. The characteristic of MA that can be support or resistance can be the "tool" that we can use to minimize our risk during our trade. Note the example below:

In this example, we assume MA200 as support and has a long open position. By knowing that, we can set our SL under this support line.

One of the disadvantages of MA is that it cannot be used when the market is in correction phase or the "Consolidation”. Examples below indicate the disadvantages of MA when the market is not in trend; uptrend or downtrend.

Be careful with the "lag" of MA. Because all of the MA indicators are lagging, the signal provided by the MA is often slow even though the market has made its movement. This phenomenon often occurs when using MA.

Crossover is one of the principle when using MA;when the market moves from the top to the down of MA, or vise versa.

Another method of “crossover" is using more than 1 MA. This type of "Crossover" is valid when "shortterm" MA across above "longterm" MA.

This method is use to identify the "momentum" or the strength of the market movement. Long signal generated when the shortterm MA cross above long term MA while short signal generated when shortterm MA cross below longterm MA.

Example below shows the signal to entry position LONG result of crossover

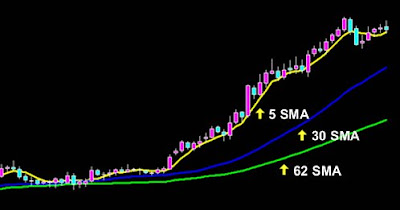

"Triple crossover" is a way of using 3 types of MA all together. For example MA5, MA10 and MA20 cross between one another. By adding more MA, the false signals may be reduced.

Example of buy signal:

When MA5 cross with the MA10 and ascended to the top, this shows the buy signal was created. However, traders may wait until MA10 and MA20 cross once again and rise to the top. The crossing between MA10 with MA20 can be used to confirm the buy signal generated by initial signal of the MA5 and MA10.

Friday, May 22, 2009

Forex indicator: Moving Average (MA)

Labels: Forex indicator, MA, Moving Average

Posted by just me at 10:26 AM 0 comments

Introduction to Technical Analysis

Labels: Lagging Indicators, Leading Indicators, Technical Analysis

Posted by just me at 8:24 AM 0 comments

#1 Types of Candlestick

Labels: Candlestick, Technical Analysis

Posted by just me at 7:39 AM 0 comments

Tuesday, May 19, 2009

#4 Forex Currencies

Currency nickname

Sometime in the news reports issued by forex agencies news,currencies also recognized with numerous fictitious name or nickname. Do not surprised when you read news and you will found greenback, cable, kiwi, aussie, and so forth as a currency name. That is just as fictitious name or nickname only. Here is part of the nickname for some currencies:

• USD = greenback

• GBP = cable

Major vs. Minor Forex Currencies

There are 7 main forex currencies(major currency) that often been trade by trader that is USD, GBP, EUR, CHF, JPY, AUD & CAD while NZD & SGD are minor currencies which did not become merchants or favorite by many traders.

Labels: currencies nature, Currency nickname, forex currencies, Introduction to Forex, major currencies, minor currencies

Posted by just me at 5:50 PM 0 comments

#3 Differences between Forex market and stock

Forex Trading is far better when compare to proportionate share. This is based on several factors below:

1) There is no commission charge to the traders.

2) Transaction Cost is low.

3) Market liquidity is very high. With only one click you can earn its profit.

4) Leverage is very high with a small capital.

5) No Insider,false news and fraud syndicate as often occur in the stock market.

6) Commodity Market opens 24 hours everyday throughout the week.

The other difference between forex market and a stock is that forex market operates globally and can include any and every country of the world; stock markets on the other hand operate in shares and businesses which belong to a specific country. The forex market covered nearly every country of the world.

Labels: forex vs stock, Introduction to Forex

Posted by just me at 5:29 PM 0 comments

Monday, May 18, 2009

#2 Basic introduction to Forex

Forex is one of the world largest instruments of investment with total trading nearly 3.2 trillion USD daily. It is far exceed any stock exchanges of the world. Unlike stocks and futures exchange, Forex is certainly an interbank, over-the-counter (OTC) market which means there is no single universal exchange for exact currency pair. The foreign exchange market open 24 hours everyday throughout the week between banks with banks, individuals with Forex brokers, and lastly brokers with banks.

Again unlike stoke exchange, Forex commodity is a 2 way market which means you can make the profit by bull(buying)or bear(selling) the currency pairs by following the movement of the currency. The Forex’s profit potential comes from the changes in the currency exchange market. By knowing the trend of the currency movement with some extra skill and knowledge (fundamental and technical analysis) one can easily be able to make a huge profit from Forex.

Did you know what is leverage in Forex ? Leverage is one of Forex advantages. Basically it is the ratio of investment to actual value. Using $100 to entry trading contract with a $10,000 at a 1:100 ratio. The $100 is all you risk, but the profits you can gains may be many times greater than what you are expected.

The risk in Forex- Experts always say when you are in market make sure to use only 10 percent of your capital (equity).The trader also must be familiar with term ‘margin’.Margin mean you cannot lost more than your initial investment. Of course

your gains are unlimited but you will never lose more than your initial investment. So be advised to never risk more than you can afford to lose.

Labels: Forex advantages, Introduction to Forex, leverage, stoke exchange

Posted by just me at 10:46 PM 0 comments

#1 History of Forex(Foreign Exchange)

Forex come from word Foreign exchange. For simplicity Foreign currencies are define as currencies that constantly and at the same time bought and sold across local and global markets. Furthermore traders’ investments increase or decrease in value based upon currency movements.

Before World War I, nearly all central banks supported their currencies with convertibility to gold. Although paper money could always be prefer to be change for gold, in some cases this did not happen often, fostering the sometimes ruinous notion that there was not essentially a need for full cover in the central reserves of the government.

Before 1996,Forex market is open only to experts exclusive, including bank institution, High Net Worth Individual and Conglomerates multi millionaire because to entry the market one individual need about 10 million USD, because of that Forex is not very popular among Low Investment’s individual for that time because of high capital funding. Daily amount of a commodity is also under 500 million USD.

In early of 1996 ,Forex is open to public after been passed by the President of America, Bill Clinton at that time. Since that, many broker Forex registered and the amount of merchandise increase every year. Now, approximately 2.5 trillion USD was trade daily.

Now, the number of broker registered keep increasing daily and because of the competition between them the minima capital to entry trading become smaller and smaller. There are some broker even offer 1 USD as a minima capital to entry trading nowadays.

Labels: forex history, Introduction to Forex

Posted by just me at 10:12 PM 0 comments